Home » What to make of the stock markets today, given the recent downturn? What should I do as an investor – buy, sell, or hold? When will the market bottom out? Should I wait for it?

What to make of the stock markets today, given the recent downturn? What should I do as an investor – buy, sell, or hold? When will the market bottom out? Should I wait for it?

When will the market bottom out? Should I wait for it?

Author

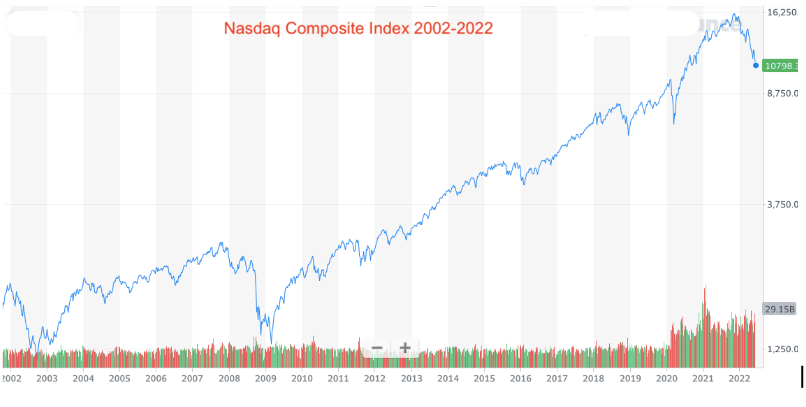

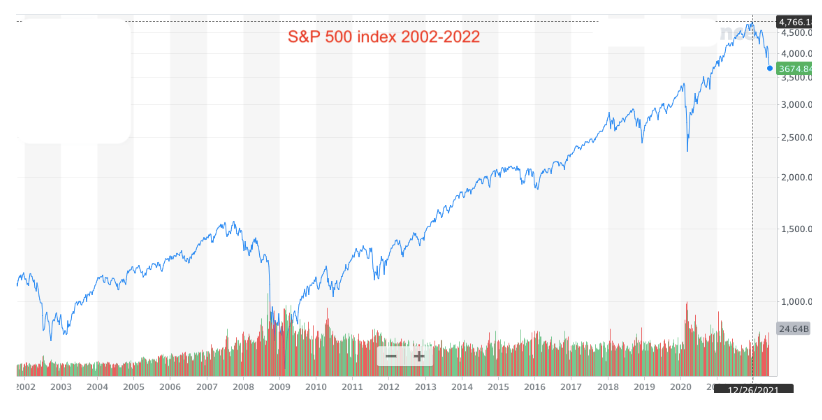

Let us see a long term chart of two indexes: the tech-companies-heavy NASDAQ Composite and the bellwether S&P 500 as of June 2022. Both charts represent 20 years, and critically, are logarithmic, not linear.

In logarithmic representations, every inch up the Y-axis represents a fixed percentage increase in price, versus a fixed number of points in linear charts.

Here we get a much better understanding of how much the current downturn / correction / bear market is as a percentage, compared to earlier up- and down-swings which were from a lower base.

Yes, we see a dip in prices of almost 30 percent since the top of the market six months ago. And this can seem jarring to a lot of investors, especially those bought in big at the peak. But that can be seen as a once in a decade discount by smart, long-term bargain hunters.

But take a step back and we also see that the market is still very much in an upward trend, not only from way back since 2002, but as recently as 2019! This is an important point to note.

Secondly, it was possible that the markets had anyway gone up too much too fast i.e. there was irrational exuberance / optimism / greed, which was very much due for a correction.

Lastly, the valuations of companies – which indicated long-term prospects – are still not “bubble” territory, i.e. not over-inflated. How do we gauge this? One way is to compare the current P/E (price to earnings) ratio of the index versus its own historic average P/E. We see that neither the S&P 500 nor the Nasdaq are too far away from their historic average valuations.

The US Federal Reserve (Fed) is increasing interest rates, so as to reduce the flow of cheap-to-borrow money into the markets. This should put downward pressure on inflation rates i.e. rising cost of goods and services. High inflation was an expected effect of years of cash flows into the US economy.

“Moral of the story” for investors:

Stick with it (your well-thought-through plan of action), stay invested [see note 1], and even better to keep investing fixed amounts of money regularly (dollar cost averaging or regular savings plans) in low-cost, blue-chip index-tracking funds. You will reap huge rewards in years and decades ahead.

Notes:

- Why stay invested? Because it is nearly impossible to time the market. One can never tell exactly when the market has begun a rebound, and those rebounds are often dramatic. If you miss them, you can miss a large chunk of gains.

- Why are we talking about the US markets here? It is because, as they say, when the “US sneezes the world catches a cold”. Meaning, what happens in the US and the actions that their government takes, affects the whole world’s markets and many governments’ monetary policies.