Home » So… Twitter is being bought by Elon Musk for 44 billion dollars!

So… Twitter is being bought by Elon Musk for 44 billion dollars!

Author

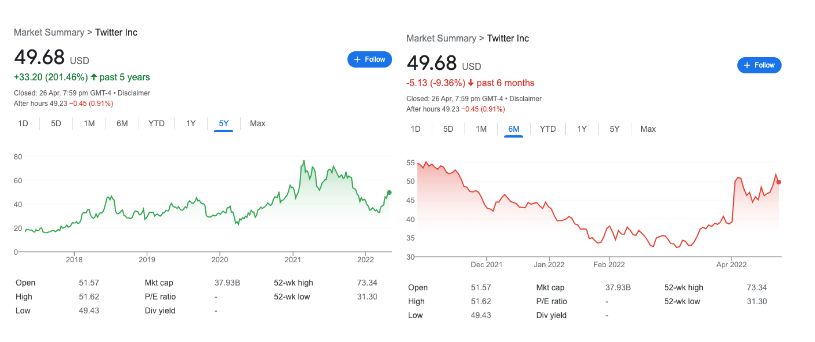

Just weeks ago, the company was trading at a third less in market capitalization (i.e. current price per share x total number of shares outstanding) – at about 30 billion dollars.

In two months, from early March to late April 2022, shareholders made over 50% profit. The share price has gone up from about $32 to $49. Twitter reported it would be acquired by Elon Musk for $54.20 per share.

And in general, what can we make of publicly traded companies (that are listed on a stock exchange) being taken private?

Reasons and motivations

This happens when there are a group of people or entities – either an external consortium, or the company’s managers or current shareholders – want to take full control of a company, and not want to endure the burdens (such as additional regulatory filings) and disadvantages (such as less privacy of financial statements) of being publicly traded. It could also happen when the exchange requires it because the company does not meet certain criteria of listed companies such as minimum volume of shares traded or market capitalization or profit.

A big motivator for buyers of whole companies is to unlock the value that could be kept suppressed by the old management – such as by selling of certain assets (those that may have seen a big price appreciation a lot or those that are non-performing) or divisions of the company.

This can sometimes be a windfall for shareholders. This is because usually the price offered to existing shareholders to give up their shares is higher than the current stock price – just as we see Elon doing.

But there is another side to the story – a company is taken private usually when the buyer sees that it is UNDER-valued by the stock market. That is why many existing shareholders do not agree to the sale – they try to hold out for a higher price by the buyer, or stay publicly traded till the market values the company more.

In the case of Twitter, Elon quietly bought his initial 9.2% of the company’s outstanding shares by March, when the stock price was relatively low, and no one was aware of what was going on behind the scenes until such time that he had to report it publicly i.e. make required regulatory filings.

The moment people got wind of Elon’s interest, the share price started sky-rocketing. I am sure Elon knew this would happen, and he was prepared for it. Which is to say, the shares he bought earlier were a bargain, likely at an attractive discount in his view.

I have been fortunate to have owned several companies whose shares I had bought that went private in under 5 years of holding them.

So what should we as investors look out for if we wish to buy companies that have a good chance of being taken private?

This is similar to property investors wanting to buy an apartment in a condominium that can be sold en bloc to a real estate developer at a premium to market prices.

Well, in general the answer would be similar to buying a good company at a reasonable price. That is, first doing one’s due diligence, understanding the fundamentals of the organisation, its SWOT (strengths, weaknesses, opportunities, threats), and having an intrinsic value in mind. If the market price is lower (ideally, much lower) than this intrinsic value, then you enjoy that all-important margin of safety.

I personally prefer companies that have:

- A low price to earnings ratio (same with price to cash flow). In other words, high earnings power (E/P).

- A low price to book value (i.e. assets less liabilities) ratio.

- Low debt levels.

- A decent growth rate in revenues and earnings.

- A healthy and sustainable profit margin.

- Economic tailwinds for their industry and how the company is positioned in it.

- Reputable brand value.

- Good acumen, integrity, and longevity of its managers (leaders).

- Use of technology to save costs. Spending on research and development (R&D).

- Healthy ownership by the insiders of the company, such as its management.

In addition to the above, if I see that the insiders and/or large shareholders own a majority of the company already i.e. not too many shares are in float (non-restricted stock, shares freely available to trade in the market), then I know that it is easier for the company to be taken private. This is because the large shareholders need to raise a relatively small amount of additional capital to buy out all the remaining shares which they do not own. It also means that they can force the privatisation process to go ahead in spite of the few minority shareholders who are rejecting their offer.